Paranoid guardians and super competitive forces

In Only the Paranoid Survive, former Intel CEO Andy Grove reminds us that “business success contains the seeds of its own destruction”. The more profitable your business, the more barbarians you can expect at the gates. The manager’s “prime responsibility” then, Grove says, is to defend against such attacks and to instill a “guardian attitude” in the company’s ethos. Anticipating these threats, however, is easier said than done. Fortunately for us, Grove shares some thoughts on the matter – the focus of this post.

Skip ahead

- The five forces of industry dynamics

- Strategic inflection points

- Horizontal and vertical computing

- Watch for Chaplinian denial

The five forces of industry dynamics

Inspired by Michael Porter’s Competitive Strategy, Grove says there are five forces in business.^ They are the strength and number of existing and potential: (1) customers, (2) competitors, (3) suppliers, (4) substitutes, and (5) complementors. Substitutes and complementors, Grove says, deserve more attention. Substitutes, in particular, can be “the deadliest of all” – new technologies frequently “upset the old order”.

Complementors, likewise, are just as important, but in the opposite sense. They offer goods and services that make your company more valuable. Hardware and software businesses, for example, are complementors. As are automakers and auto insurers. (For more on complementors, I highly recommend Adam Brandenburger and Barry Nalebuff’s Co-opetition.)

^Actually, Grove says there are six forces. He distinguishes between potential and existing competitors. But I think it more fruitful to think about existing and potential players in each of the five categories. So, I’ve consolidated the list for simplicity.

Ordinary and supercompetitive

For each of these five categories, Grove likes to distinguish between ordinary and “super competitive” forces. Super competitive forces, of course, are the game changers of industry – like air travel to railroads, or the internet to print. They produce winners and losers.

“But in capitalist reality, as distinguished from its textbook picture, it is not (price) competition which counts but the competition from the new commodity, the new technology, the source of supply, the new type of organization … competition which … strikes not at the margins … of the existing firms but at their foundations and their very lives.”

Joseph A. Schumpeter. (1942). Capitalism, Socialism and Democracy.

Strategic inflection points

Given enough time, “something fundamental in your business world will change”. These “strategic inflection points” will either elevate the company “to new heights”, or “signal the beginning of the end”. One symptom of inflection, Grove says, is “growing dissonance” between the organization’s actions and its economic reality. Management may blame their underperformance on ‘temporary’ setbacks, when the market is actually leaving them behind.

But even if the super competitive force is obvious, it’s difficult to know what to do and when. If you wait until you have all the information, it might be too late. Ideally, the company is making necessary adaptations while healthy and profitable. Yet companies often do too little during the calm, only to scramble for survival once calamity hits. Many executives lack the paranoia that is necessary to survive strategic inflection points. Businesses “need to play the way a fire department plans”.

Horizontal and vertical computing

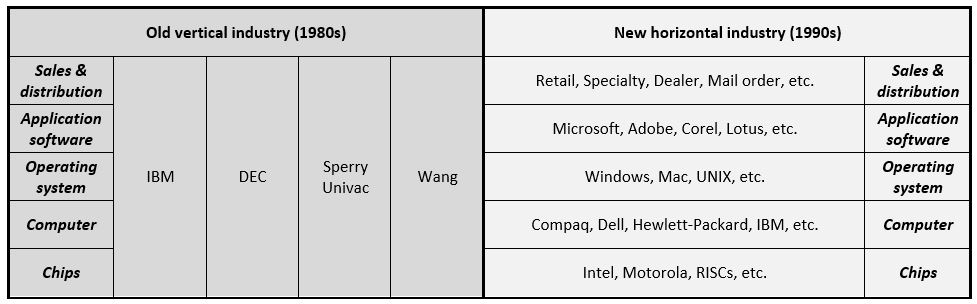

One of the best-case studies on strategic inflection points, I think, is the computing industry’s transition from a vertical structure in the 1980s to a horizontal stack in the decades that followed. As Grove describes it, companies like IBM and DEC were “vertical proprietary [blocks]” under the old regime. They made their own semiconductors, computers and operating systems. They also handled marketing and distribution themselves.

Vertical ownership created a “seamless total” for consumers. It also raised switching costs because buyers had to buy into one block or another. This in turn generated intense competition for the first sale. In some ways, the old computing industry was similar to razor-blade models in other industries today (e.g., printers and cartridges, elevators and servicing, and so on).

New kids on the block

The landscape, however, shifted with advances in microprocessors – technology to put “what before had been many chips on one single chip”. Once microprocessors “became the basic building block of the industry, … manufacturing computers became extremely cost-effective”. Old vertical structures began to erode. By the mid- 90s, people could select from “ready-to-use applications off the shelf” that mixed-and-matched different chipmakers, computer manufacturers and operating systems. Sales and distribution channels, likewise, diversified and proliferated.

Computing industry structure

Companies like IBM, which thrived under the old order, “slowed down as much of computing went from mainframes to microprocessor-based personal computers”. Newcomers on the other hand, like Intel, Microsoft and Dell, grew “into pre-eminence”. Others, which found their original business becoming increasingly unprofitable, refocused their efforts elsewhere. Novell, for example, abandoned their hardware business to redouble their efforts on networking software. Grove had this to say about the computing transition:

“First, when a strategic inflection point sweeps through the industry, the more successful a participant was in the old industry structure, the more threatened it is by change and the more reluctant it is to adapt to it. Second, whereas the cost to enter a given industry in the face of well-entrenched participants can be very high, when the structure breaks, the cost to enter may become trivially small, giving rise to Compaqs, Dells and Novells, each of which emerged from practically nothing to become major corporations.”

Andrew Grove. (1988). Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company.

Horizontal bias

Many businesses, Grove says, “live and die by mass production and mass marketing”. They price for volume and work hard on costs to generate economies of scale – a typical strategy for market dominance. Cost-based pricing, by contrast, “will often lead you into a niche position”. That’s not to say one strategy is right or wrong. It’s a simple comment about directionality. Grove believes that many industries have an innate propensity to transition towards horizontal structures.

“I also think that there is a general trend toward horizontally based structure in many parts of industry and commerce: As an industry becomes more competitive, companies are forced to retreat to their strongholds and specialize, in order to become world class in whatever segment they end up occupying. … By virtue of the functional specialization that prevails, horizontal industries tend to be more cost-effective than their vertical equivalents. Simply put, it’s harder to be the best of class in several fields than in just one.”

Andrew Grove. (1988). Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company.

Watch for Chaplinian denial

Why do so many executives struggle to navigate strategic inflection points? Some of them are “sheltered from news from the periphery”. Others retain “enormous confidence” in the status quo that birthed their original success. The “most important” factor, Groves believes, is probably plain-old psychological denial. The impact of the new order is sometimes “so painful as to be inconceivable”. Emotionally, it is often easier to deny than to accept and adapt.

Grove recalls, for example, how Charlie Chaplin, in a 1931 interview about the advent of sound in television, said “I give the talkies six months more”. Chaplin could not or did not want to fathom a new era of television. His entire identity and livelihood were, after all, based on silent film making.

Grove parallels this to the 1980s computing industry, when the head of Digital Equipment Corporation (DEC) – “the largest minicomputer maker at the time” – believed that personal computers were “cheap, short-lived” machines. IBM’s management, likewise, attributed their recent troubles to “weakness in the worldwide economy”, not to their failure in strategic positioning.

“Looking back may be tempting, but it’s terribly counterproductive. Don’t bemoan the way things were. They will never be that way again. Pour your energy, every bit of it, into adapting to your new world, into learning the skills you need to prosper in it … Whereas the old land presented limited opportunity or none at all, the new land enables you to have a future whose rewards are worth all the risks.”

Andrew Grove. (1988). Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company.

Eroding sentiment

Business and investors must pay attention to buyer habits. A gradual shift in demand, Grove says, is “the most subtle and insidious cause of a strategic inflection point”, precisely “because it takes place slowly”. Fashion brands, advertising agencies, and toy makers, for example, are well accustomed to the ebbs and flows of change. Lumbering behemoths, by contrast, that’ve enjoyed decades of stability, are probably less prepared for major inflection points.

Grove describes, for example, how General Motors, in a post-World War I United States, recognized the market’s growing desire for “style and leisure” in automobiles. With this insight, the company introduced a more varied and fashionable product line, along with regular model updates – leapfrogging Ford, who were slow on the uptake. You can parallel this, I think, to what’s happening in the electric vehicle market today.

Competitive exclusion

Finally, it’s important to remember that super competitive forces come not only from your customers, but from potential competitors and substitutes as well. Walmart, for example, is a super competitive force for small-town retailers. How might one survive in the wake of Walmart? Grove says superior specialization and customized service might offer “a good chance”.

Sometimes, you have to redefine your product, experience, and environment. Some independent bookstores, for example, turned to hybrid coffeehouses to compete with growing retail chains and e-book companies. Intel, likewise, pivoted into microprocessors when it found itself unviable in its core memory segment – a painful but necessary shift in identity.

When the principle of competitive exclusion is working irreversibly against you, your company may have to move to rosier pastures. To paraphrase Peter Thiel in Zero to One, conflating competition with opportunity might ascertain hardship and disaster. Sometimes, a graceful exit is truly the best course of action.

Reference

- Grove, Andrew. (1988). Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company.

Recent posts

- The Trusted Advisor — David Maister on Credibility and Self-Orientation

- How We Learn — Stanislas Dehaene on Education and the Brain

- Catching the Big Fish — David Lynch on Creativity and Cinema

- Donald Murray on the Apprentice Mindset and Return to Discovery

- The Hidden Half — Michael Blastland on the Unexpected Anomalies of Life

- Artificial Intelligence — Melanie Mitchell on Thinking Machines and Flexible Humans

- Fallibility and Organization — J. Stiglitz and R. Sah on Hierarchies and Polyarchies

- The Art of Statistics — David Spiegelhalter on Reasoning with Data and Models