Exponential branching

In his article Predicting the Unpredictable, physicist William Firth writes that “predictability is the exception rather than the rule, even for what seem like simple physical systems.” Our intuition for chaos and unpredictability, however, is distorted in part by the niceties of our classroom education and the success of Newtonian mechanics. Since we know the laws of motion that govern our planetary orbits, surely everything else must be determinable, right? The nineteenth-century polymath Pierre-Simon Laplace thought so, at least in principle. He suggested that if some supreme calculator knew the relevant laws and exact position and velocity of every particle in the Universe, then it could map the future of history like clockwork.

This Laplacian ‘demon’, however, hides important assumptions. For one, as Firth notes, it assumes that “the calculational power required increases only in rough proportion to the number of particles and the time forward for which prediction is sought.” Unfortunately, this is not the case, for “the increase is exponential.” This should not surprise us. After all, the branching possibilities of many systems, from chess to weather to markets to evolution, grow immensely the deeper and further we look. “To predict the weather for even just a few years would require that the entire universe be fabricated into a single giant computer”, Firth notes. (Perhaps this lends credence to futurists who believe that the Universe itself is the simulation.)

Small events, big effects

The Laplacian demon further assumes that “small causes have small effects.” And that small inaccuracies lead only to small errors in prediction. While this is true for linear systems, many systems of life are non-linear. Small events, causes, or inaccuracies can generate outsized differences. The mathematician Edward Lorenz discovered this in his simple, deterministic yet chaotic models of atmospheric convection. He found that even the tiniest of perturbations in his models led to widely diverging weather patterns. Such sensitivities and uncertainties led Lorenz to speculate on the butterfly effect. Might “the flap of a butterfly’s wings in Brazil set off a tornado in Texas?” As Firth writes, “it follows that the determinism of the Lorenz model (and by extension of Laplace) is only mathematical: the physical universe is unpredictable, even if deterministic, because of unavoidable uncertainties in our knowledge.”

Today, we find chaos everywhere. In astrophysics, interactions between three or more celestial bodies can, under the right parameters, generate chaotic orbits. Chaos can also occur in the dynamics of prey-predator populations in ecology and viral transmissions in epidemiology. It may also arise in the human body, as when arrhythmia occurs in the heart, or epilepsy in the brain. Even leaking faucets and traffic flows may exhibit chaotic behavior.

Looks at itself

It’s worth adding, Firth writes, that in addition to its initial conditions and the environment, “the behavior of a nonlinear system [usually] depends upon its own state: it ‘looks at itself.’” Stock markets, for example, are performative, reflexive systems. Its behavior is driven in part by anticipation of the future, the anticipation of anticipation, and so on. Not only that, the system shapes and is shaped by the theories and beliefs that seek to understand it. So it is not difficult to imagine how a mixture of positive and negative feedback loops might generate tremendous instability and unpredictability. The mathematician Benoit Mandelbrot parallels the misbehavior of markets to the laminar flows and turbulence in fluid dynamics.

While chaos implies unpredictability, the system may still exhibit statistical regularities and invariant measures. For an analogy, it is easier to describe the distribution of rainfall than it is to predict whether or not it will rain one hundred days from now. And it is similarly easier to recall the rough outline of the world map than it is to draw its detailed contours. As the mathematician Ian Stewart writes in Do Dice Play God, it is vital to distinguish between weather and climate-like prediction. You see, “weather is a single path through an attractor, whereas climate is the whole attractor.” That is, “if you start somewhere else, you get a different trajectory, but it ends up spiraling around the same mask-like shape.”

Coexistent attractors

Moreover, systems may contain more than one attractor. The human heartbeat, for example, as Firth notes, may transition from a healthy oscillation to irregularity (arrhythmia) to a fixed-point (cardiac arrest), and vice versa with intervention and luck. “Coexistent attractors” of this sort, he notes, “lead to a new kind of unpredictability.”

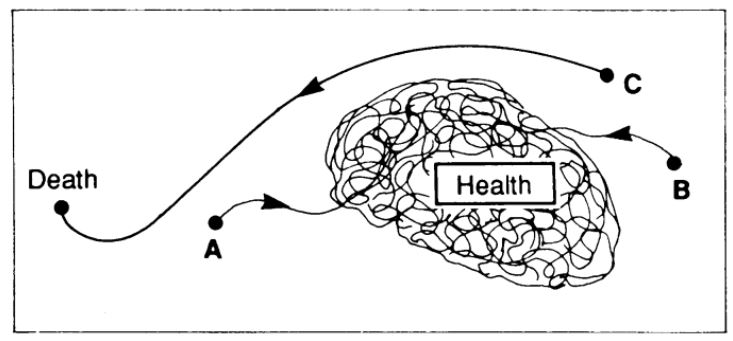

To borrow his schema, we can imagine, for instance, that there exists two multi-dimensional attractors in the human body. One corresponds to ‘health’ or ‘living’, the other to ‘death’ (Figure 1). Under many conditions, the body is able to repair, maintain, and regulate itself. This process continues in a haphazard yet orderly way, at least until senescence brings the body to a fixed-point at death. External factors, like injury, illness, and intervention, may also ‘jump’ the system—pushing it from one trajectory, towards health or death, to the other.

Figure 1. ‘Health’ and ‘death’ as coexisting attractors

Similar mental models may apply to economics. Markets, for the most part, provide an effective, decentralized mechanism for the organization and allocation of scarce resources. But there are times when public intervention is necessary to ensure the invisible hand is healthy and functioning. This includes the provision of public goods and the enforcement of property rights. Without our institutions, the system would probably degenerate into an economic backwater.

What’s more, there are periods when the economy itself, due to its own internal dynamics, descends into irregularity and stagnation. Two prominent cases, of course, include the Great Depression and the Global Financial Crisis. The Depression, in particular, lasted for ten years, ending only after The New Deal and the start of the Second World War. The Financial Crisis, likewise, spurred federal governments and central banks around the world into firefighting—staving off what might have been a financial implosion and protracted depression.

Predicting the unpredictable

Of course, these mental models of chaos and nonlinearity may oversimplify the interesting features of nature, society, and the economy. But they help us to remember the potential, unpredictable and disparate trajectories that these systems can take. As Firth concludes, “the universe may be predetermined but there is no conceivable experimental procedure by which we could determine the future.” Alvin Toffler agrees in the preface to Order Out of Chaos. He reminds us that “most of reality, instead of being orderly, stable, and equilibrial, is seething and bubbling with change, disorder, and process.”

Sources and further reading

- Firth, William J (1991). Chaos—Predicting the Unpredictable.

- Prigogine, Ilya. (1984). Order Out of Chaos.

- Stewart, Ian. (2019). Do Dice Play God?

- Mandelbrot, Benoit. (2004). The Misbehavior of Markets.

- Thomas, Lewis. (1974). The Lives of a Cell.

- Krugman, Paul. (1995). The Self Organizing Economy.

- Dyson, Freeman. (1988). Infinite in All Directions.

- Ferris, Timothy. (1992). The Mind’s Sky.

Latest posts

- What’s Eating the Universe? Paul Davies on Cosmic Eggs and Blundering Atoms

- The Dragons of Eden — Carl Sagan on Limbic Doctrines and Our Bargain with Nature

- The Unexpected Universe — Loren Eiseley on Star Throwers and Incidental Triumphs

- Bridges to Infinity — Michael Guillen on the Boundlessness of Life and Discovery

- Ways of Being — James Bridle on Looking Beyond Human Intelligence

- Predicting the Unpredictable — W J Firth on Chaos and Coexistence

- Order Out of Chaos — Prigogine and Stenger on Our Dialogue With Complexity

- How Brains Think — William Calvin on Intelligence and Darwinian Machines

- The Lives of a Cell — Lewis Thomas on Embedded Nature

- Infinite in All Directions — Freeman Dyson on Maximum Diversity